Property Transactions and Prices are Moving in Tandem but to Different Scales

In the ever-fluctuating world of real estate, understanding the dynamics between property transactions and prices is essential for both buyers and sellers. As we delve into the data for England and Wales from the year to end July, it becomes clear that these two key indicators, though correlated, often move to different scales. In this blog post, we will examine the recent trends in property transactions and prices and consider whether a fall in sale volumes translates into an equal fall in property prices.

Property Transactions in Perspective

To set the stage, let’s start with some numbers. In the year to end July, there were just over one million residential sales across England and Wales. This figure reflects an 11.4% decrease in volume compared to the previous year. This decline, while substantial, should be viewed in the context of the pandemic-induced market turbulence.

However, it is important to note that the current transaction volume, despite the decline, is only 7.8% below the average for the five years leading up to 2019, the pre-pandemic era. This indicates that while there has been a dip in sales, it’s not dramatically out of line with historical averages.

The Dance Between Transactions and Prices

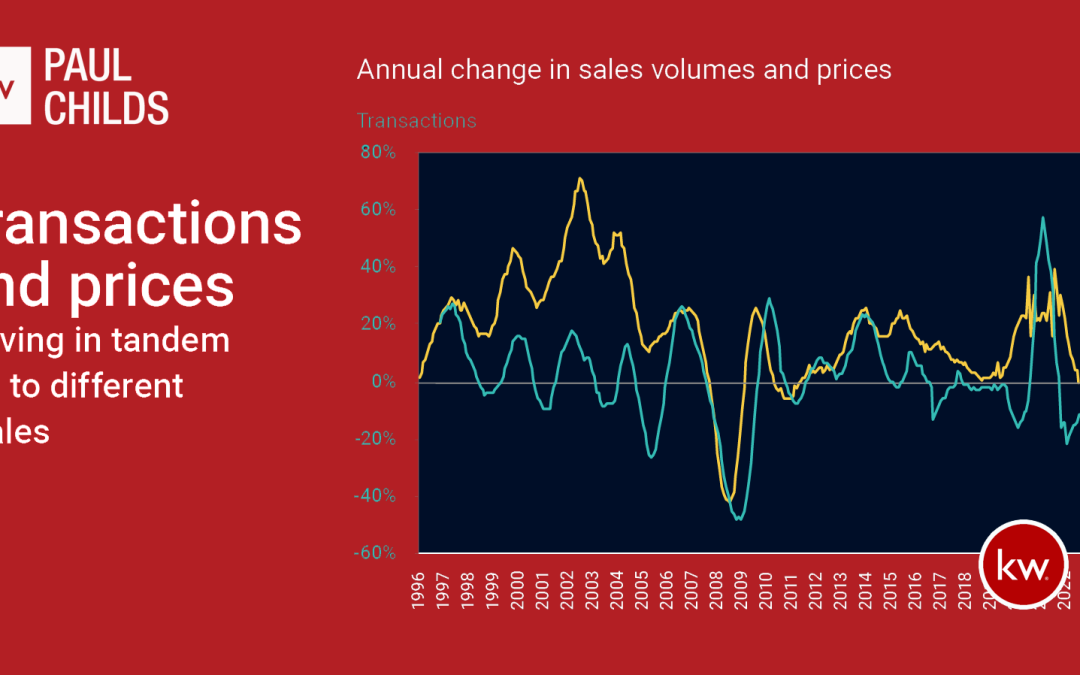

Now, let’s address the question at hand: Does a fall in sale volumes translate into an equal fall in prices? To answer this, we can turn to historical data, which shows that property sale volumes and prices tend to move in tandem through market cycles. However, the key insight lies in understanding that they do not always move in the same direction or to the same extent.

Looking back to the last housing market downturn, the worst annual fall in sale volumes occurred in the year to February 2009, with a staggering -47.6% drop. During the same period, the worst fall in property prices was -15.4%, recorded in the year to end March 2009. This divergence between transaction volumes and price movement is significant and demonstrates that while there is a correlation, the scales of change are different.

The Factors at Play

Several factors contribute to this variance between property transactions and prices during market fluctuations:

Lag Effect

Changes in property transactions typically manifest more rapidly than changes in property prices. It often takes some time for price adjustments to reflect shifts in transaction volumes.

Supply and Demand

Supply and demand imbalances can drive prices even when transaction volumes are low. In areas with limited housing inventory and high demand, prices may remain resilient despite a decrease in sales.

Market Sentiment

Buyer and seller sentiment can play a crucial role. When buyers perceive a favourable market for purchasing, they may be more willing to enter transactions, influencing volumes independently of price trends.

Economic Conditions

Broader economic factors, such as interest rates and employment rates, can impact property prices, while transaction volumes might be influenced more by local factors and personal circumstances.

Property transactions and prices in England and Wales have displayed a correlation, but they often move to different scales during market cycles. The recent decline in transaction volumes should be analysed within the broader historical context, as it is not unprecedented. Understanding the lag effect, supply-demand dynamics, market sentiment, and economic conditions is crucial for both buyers and sellers when navigating the real estate landscape.

As we move forward in 2023, keeping an eye on both transaction volumes and property prices is essential for making informed decisions in the ever-evolving world of real estate.

Source: Data provided by #Dataloft, Land Registry, and HMRC, data up to June/July 2023