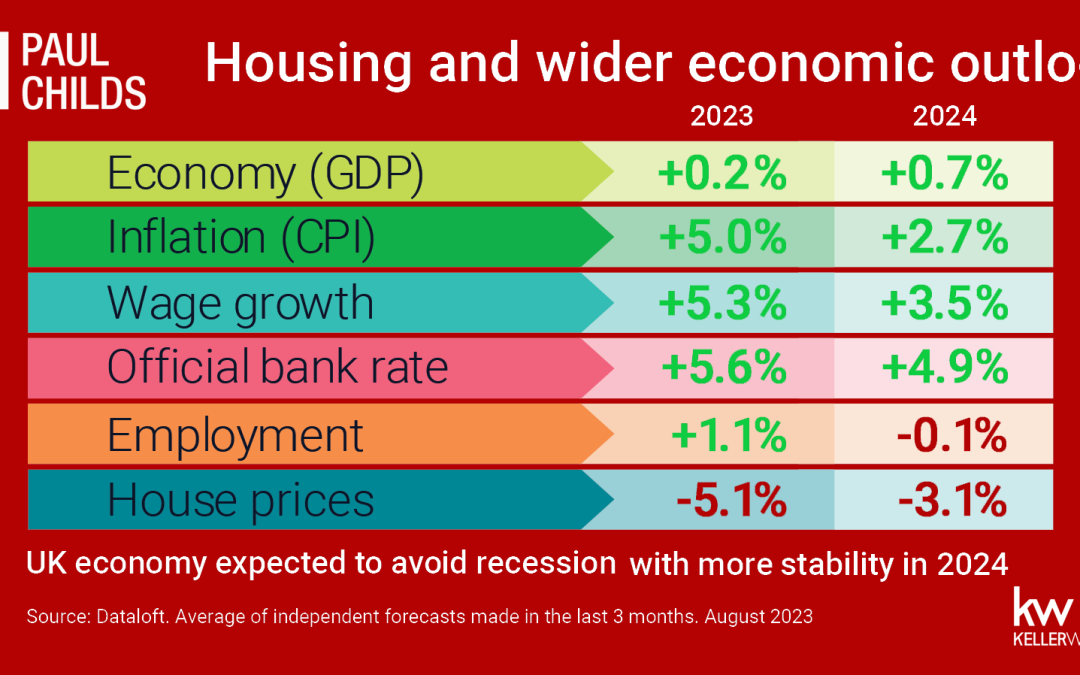

- Monitoring the outlook of various economic indicators gives us a good view on both the current and future direction of the UK’s housing market.

- With 14 consecutive interest rate rises, the Bank Base rate reached 5.25% in August. Latest projections are that rates are likely to peak before the end of the year, having successfully begun to curb inflation.

- Inflation is expected to remain ahead of target (2%) while wage growth remains high and employment continues to grow.

- More stability is expected in 2024 with the UK economy now expected to avoid recession. Nationally, house prices falls seem inevitable, but with an election on the horizon, expect some new policy incentives for first time buyers. Source: #Dataloft. Average of independent forecasts made in the last 3 months. August 2023

Unravelling the Economic Outlook

In the intricate interplay of economic factors and market dynamics, the state of a nation’s housing market often mirrors its broader economic health. This holds especially true for the United Kingdom, where vigilant monitoring of diverse economic indicators provides not only a snapshot of the present but also invaluable insights into the future course of the country’s housing market.

The Interest Rate Conundrum

A significant narrative that has shaped the UK’s economic landscape is the sequence of 14 consecutive interest rate hikes, culminating in the Bank Base rate reaching 5.25% by August. This concerted effort to curb inflation has far-reaching implications for both the economy and the housing market. Projections hint at an impending peak in interest rates, possibly by the year’s end. This inflection point not only underscores the central bank’s commitment to maintaining a stable economic climate but also sets the tone for the housing sector. With higher interest rates dissuading borrowing, the demand for housing loans might experience a tapering effect, consequently impacting the broader housing landscape.

Inflation and Economic Equilibrium

Speaking of inflation, projections indicate its persistence above the 2% target. However, this phenomenon requires contextual analysis. Elevated inflation, in this context, can be attributed to robust wage growth and a robust employment rate. As long as these underpinning factors remain steady, the effects of slightly elevated inflation could remain manageable. Nevertheless, this is a facet that demands consistent monitoring, given its potential to influence the housing market’s dynamics.

Glimmers of Stability on the Horizon

A compelling facet of the economic outlook is the optimism surrounding greater stability in 2024. With the UK economy anticipated to sidestep a recession, an air of positivity could permeate consumer sentiments and investment behaviours. This positive sentiment could cascade into the housing market, with heightened financial confidence potentially catalysing property investments. The close correlation between the trajectory of the economy and the housing market underscores their symbiotic relationship.

National Housing Price Dynamics

On a national scale, the consensus among experts is a projected decline in house prices. This aligns with recent trends in specific regions, where adjustments in property valuations have been observed. However, it’s important to recognize that these variations might not uniformly impact all segments of the housing market. While some areas might experience price moderation, others could exhibit resilience due to distinctive local dynamics.

Policy Paradigm Shifts

Intriguingly, the upcoming election harbours expectations of novel policy incentives for first-time homebuyers. This could potentially inject fresh dynamism into the housing sector, especially among individuals previously deterred by affordability concerns. Government policies wield considerable influence over demand, and even minor policy shifts in the intricate real estate landscape can yield discernible effects.

Looking Forward: A Tapestry of Prospects

In summation, the convergence of diverse economic indicators constructs a nuanced tapestry of the UK’s housing market and its wider economic fabric. The trajectory of interest rates, inflation, wage growth, and employment statistics collectively shapes the prospects and hurdles faced by potential homebuyers and investors. As the future unfurls, indications point toward a more stable economic setting in 2024, with the potential to exert a positive influence on the housing landscape. While a measure of caution is prudent due to anticipated national house price adjustments, the tantalizing prospect of policy incentives for first-time buyers might function as a countervailing force.

Strategic Navigation in a Dynamic Terrain

In navigating this dynamic terrain, stakeholders within the real estate sphere must remain watchful, adaptable to evolving scenarios, and adept at leveraging insights into the broader economic panorama. This strategic approach empowers them to make informed choices that align with current trends while also pre-emptively anticipating future shifts. As the year progresses, the intricate dance between economic indicators and the housing market will undoubtedly persist, presenting challenges and openings for those invested in the UK’s real estate sector.