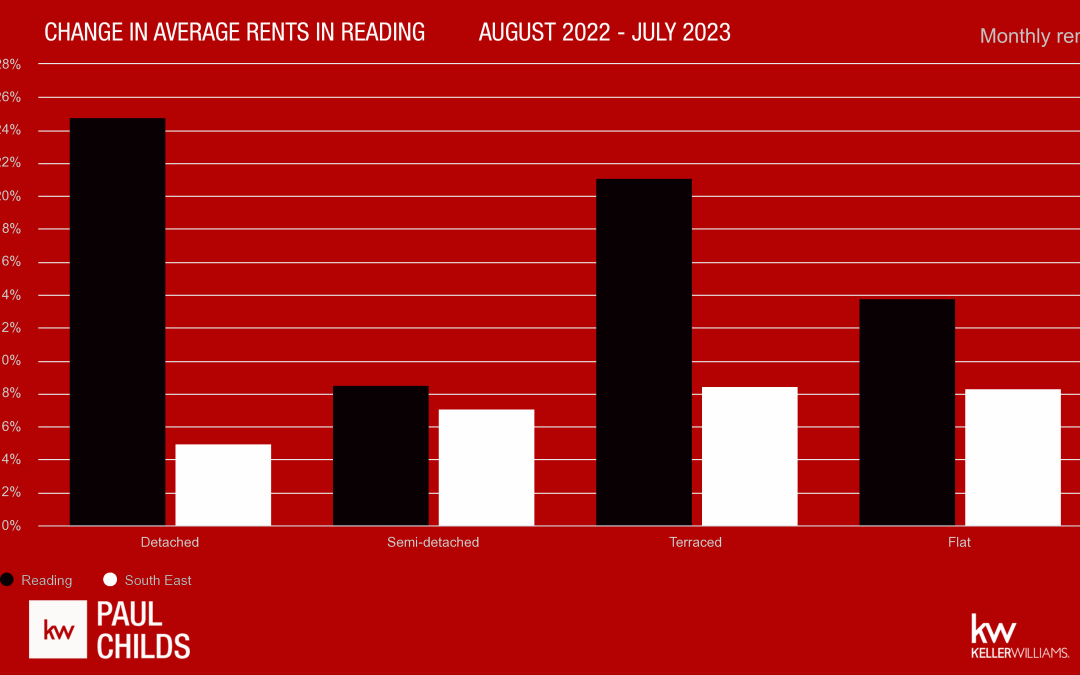

In recent years, the rental property market in Reading, UK, has experienced a significant surge in rental rates, leaving many residents and prospective tenants wondering why. In this blog, we’ll explore the factors that often contribute to such increases in rental rates and seek to shed light on the situation in Reading.

Supply and Demand Dynamics

One of the primary factors influencing rental rates is the balance between supply and demand. If there’s a high demand for rental properties in Reading, and the supply remains limited, landlords can often command higher rents. The demand for rental properties may be driven by factors such as an increase in population, employment opportunities, or the desirability of the area.

RG1 – Central Reading will always have high demand for flats within walking distance of the centre and train station taking you into London in 22 minutes. Also, there are direct bus links to TVP and Green Park.

RG30 – Oxford Road area offers property in close vicinity to the town centre but offering more houses to rent, with a high level of terraced 2/3 bed homes. With good public transport with the 24-hour, number 17 bus.

RG2 – University & RBH creates high demand for students and professionals alike which drives up prices. Also looking further towards Shinfield the opportunity of increased demand due to the opening of Shinfield Studios looking to create 3000 new jobs in the area.

Economic Growth

Economic prosperity in an area can lead to increased rental rates. Reading has seen substantial economic growth in recent years, with its status as a major business hub and home to several multinational companies. This growth has attracted professionals and increased competition for rental properties, thereby driving up prices.

Infrastructure and Transport

Reading’s excellent transport links, including its proximity to London and efficient rail services, make it an appealing location for commuters. As more people seek to benefit from these links, demand for rentals in Reading increases, pushing up rental rates.

Property Development and Investment

Investment in property development can also impact rental rates. New residential developments and property investments can improve the overall housing stock, but they can also lead to landlords charging higher rents, especially in newly constructed or renovated properties.

Within walking distance of the train station some examples of key developments:

Station Hill 1,300 new homes due for completion 2024

Thames Quarter 315 apartments completed 2022

Huntley Wharf – 765 new homes due for completion 2024

Increases in Interest Rates for Landlords

Another significant factor influencing rental rates is the interest rates faced by landlords. When interest rates rise, landlords with variable-rate mortgages or loans for property investments may face increased financing costs. To maintain their profitability, some landlords may pass these costs onto tenants in the form of higher rents. This can be particularly notable in a rising interest rate environment.

The knock-on effect will see landlords selling up due to being unable to sustain their mortgage payments, resulting in a tenant receiving a section 21 notice to vacate. One less property is removed from the rental pool, whilst increasing the demand.

Inflation and Cost of Living

Inflationary pressures on the cost of living, including housing costs, can lead to higher rental rates. Increases in utility bills, maintenance costs, and property taxes can prompt landlords to adjust rents to maintain their profitability. Not forgetting landlords could have multiple properties including their family home and will be feeling the effect with increases.

Housing Regulations

Changes in housing regulations, such as updated safety standards or taxation policies, can influence landlords’ decisions on pricing. Compliance with new regulations may require landlords to invest more in their properties, which could be reflected in higher rents.

While Reading’s rising rental rates can be attributed to various factors, the interaction of these elements is often complex and multifaceted. It’s essential for tenants and landlords alike to stay informed about the local property market and its evolving dynamics to make informed decisions.

As Reading continues to grow and evolve, understanding the reasons behind rental rate increases, including the impact of interest rate fluctuations for landlords, can help both tenants and property investors navigate the market effectively.

Useful Information for landlords & tenants

Landlords

If you are a landlord and would like to discuss how my company can be helping you in these difficult times to achieve the best rent and tenant retention, please get in contact.

- Your rights and responsibilities

- Landlord & tenancy act 1985

- Process if you need to evict tenants

- 2023 Renters reform bill

Tenants

Tenants if you are unsure of your situation, or if you are looking for a property, please get in contact with me to discuss further. In the meantime, you can find out more information at: