With the rise in interest rates, further regulation and reforms coming into play for landlord in the form of the tenants reform bill, career landlord are still looking to expand their portfolios. Accidental landlord are looking to exit the market due to the increase in time & costs to manage and maintain their properties…it is not their full time job. This creates opportunity for career landlords to help them exit the market quickly.

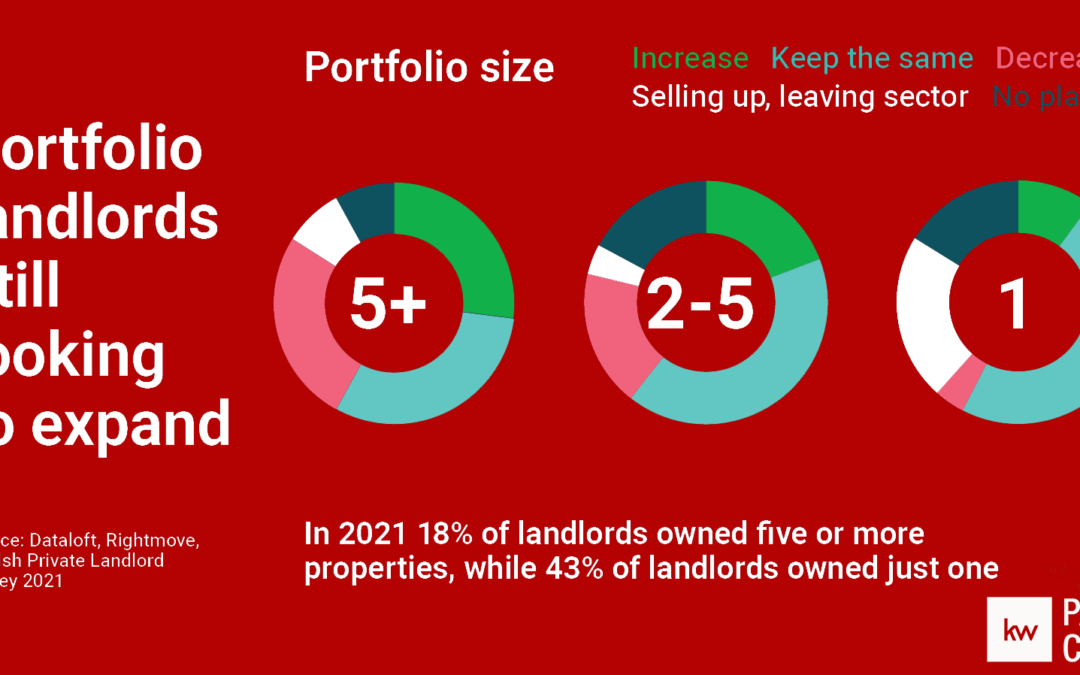

- More than a quarter of landlords who own five or more properties are planning to increase their portfolio over the next year, while one in five who have 2–5 properties are also planning to expand (Rightmove).

- Over half of landlords are planning to keep their property portfolios consistent or increase the number of properties they own. Single-property landlords are more likely to be looking to leave the sector.

- Published in 2022, the English Private Landlord Survey 2021 found that 18% of landlords owned five or more properties but such landlords represented 48% of all tenancies

- A Property Academy survey of close to 6,000 landlords indicated that over three-quarters of landlords owed less than half the value of their portfolio on their buy-to-let mortgages. Landlords with lower loan-to-value mortgages are less impacted by current market volatility.

Source: #Dataloft, Rightmove, English Private Landlord Survey 2021, Property Academy Landlord Survey 2022

In the dynamic landscape of the UK property market, a distinct group of investors stands out for their unwavering ambition and appetite for growth – the portfolio landlords. Despite the ever-changing market conditions, these shrewd investors remain steadfast in their pursuit of expanding their property empire in the United Kingdom. In this blog, we delve into the factors driving portfolio landlords’ continued interest in acquiring more properties and their strategic approach to navigating the real estate market.

High Rental Demand and Lucrative Yields

A primary driver behind portfolio landlords’ enthusiasm for property expansion is the sustained demand for rental accommodations. With a significant number of individuals opting to rent rather than buy, the rental market remains robust. This demand translates into promising rental yields, making property investment an attractive and profitable venture for these seasoned investors.

Mitigating Risk through Diversification

Portfolio landlords are acutely aware of the importance of risk mitigation in their investment strategies. By diversifying their portfolio across different geographic locations and property types, they spread their risk and reduce exposure to market fluctuations. This prudent approach to diversification contributes to their ability to weather market downturns while capitalizing on opportunities.

Weathering Market Volatility

Having experienced various market cycles, portfolio landlords possess a keen understanding of market volatility and are well-prepared to navigate through uncertainties. Their experience and knowledge allow them to make informed decisions even amidst unpredictable market conditions, demonstrating their resilience as investors.

Emphasis on In-Depth Research

Underpinning the success of portfolio landlords is their unwavering commitment to research. They conduct comprehensive market analyses, scrutinize potential investment areas, and evaluate property trends to identify promising opportunities. This meticulous research empowers them to select properties with the potential for optimal returns on investment.

Analysing Financial Viability

Portfolio landlords are highly skilled in analysing the financial viability of potential acquisitions. They meticulously assess factors such as rental income, operating expenses, maintenance costs, and potential capital appreciation to ascertain the property’s long-term profitability.

Continuous Learning and Adaptation

In a rapidly evolving industry, portfolio landlords actively pursue knowledge and stay abreast of industry developments. They attend workshops, seminars, and networking events to gain insights from industry experts and fine-tune their investment strategies accordingly.

The tenacity of portfolio landlords in pursuing property expansion in the UK property market is a testament to their astute investment acumen and dedication to their craft. Driven by strong rental demand, lucrative yields, and their commitment to risk management, these investors continue to thrive in an ever-changing real estate landscape. Armed with their in-depth research, financial acumen, and adaptability, portfolio landlords exemplify a steadfast commitment to sustainable growth in the UK property market.