Unrelenting Market Forces Pushing Rental Prices to New Heights

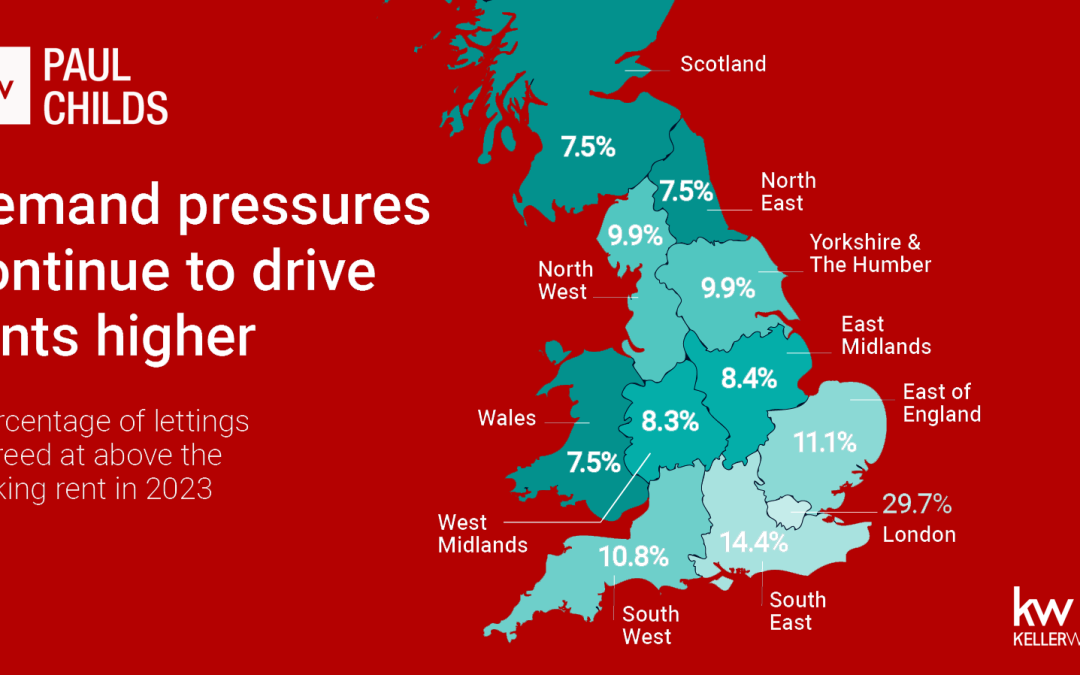

In the ever-evolving landscape of the British real estate market, a startling trend has emerged, defining the dynamics of rental transactions. According to recent analysis conducted by Dataloft, an increasing proportion of rental deals, nearly one in six in 2023, have been settled at a price surpassing the initial asking rent. This represents a notable shift from the landscape in 2019, where such occurrences were rarer, happening in less than one in 15 transactions.

The impact of this trend is particularly pronounced in London, the bustling metropolitan hub where a staggering 30% of rental agreements this year have exceeded the originally proposed rental prices. This surge in prices isn’t unique to the capital alone; it reverberates across various regions in the UK, marking a widespread phenomenon reshaping the contours of the rental market.

Regions such as the South East, known for its economic vigor and diverse residential landscape, have experienced a considerable proportion of new rentals being finalized above the initially proposed rents, tallying up to 14% of the total. Similarly, other regions, including the East of England, North West, South West, and Yorkshire & Humber, have not been immune to this trend, with over 10% of rental transactions surpassing the initial rent expectations. These figures underscore the intense pressure created by the persistent disparity between rental demand and available supply, a trend that has been escalating since the onset of the global pandemic.

The housing market’s response to the unprecedented challenges posed by the pandemic has been tumultuous, with the demand for rental properties outstripping the available inventory. This persistent pressure has led to a remarkable 41% surge in average monthly rents since 2019, far surpassing the growth in house prices during the same period, which stood at 25%.

However, beyond the statistics lies a more profound narrative of the evolving dynamics of modern living and the socioeconomic realities within the UK. The ramifications of this unyielding upward pressure on rental prices are far-reaching, impacting not just the financial aspects but also the social fabric and community dynamics across the nation.

As the housing market grapples with the implications of these ongoing dynamics, it is becoming increasingly imperative for all stakeholders to come together and redefine the landscape of the rental sector. Tenants, landlords, and policymakers must collaborate to implement proactive measures that restore equilibrium and ensure that the fundamental right to secure and affordable housing remains accessible to all segments of society.

In the face of these market upheavals, it is crucial to adopt a holistic and forward-thinking approach towards housing policies. These policies must take into account the evolving needs of the population, fostering a rental market that is not only sustainable but also inclusive and stable. By fostering collaboration and proactive decision-making, the UK can pave the way for a more equitable and sustainable rental market, addressing the pressing housing needs of its diverse population.

What is Happening in the Reading Rental Market

Reading overview

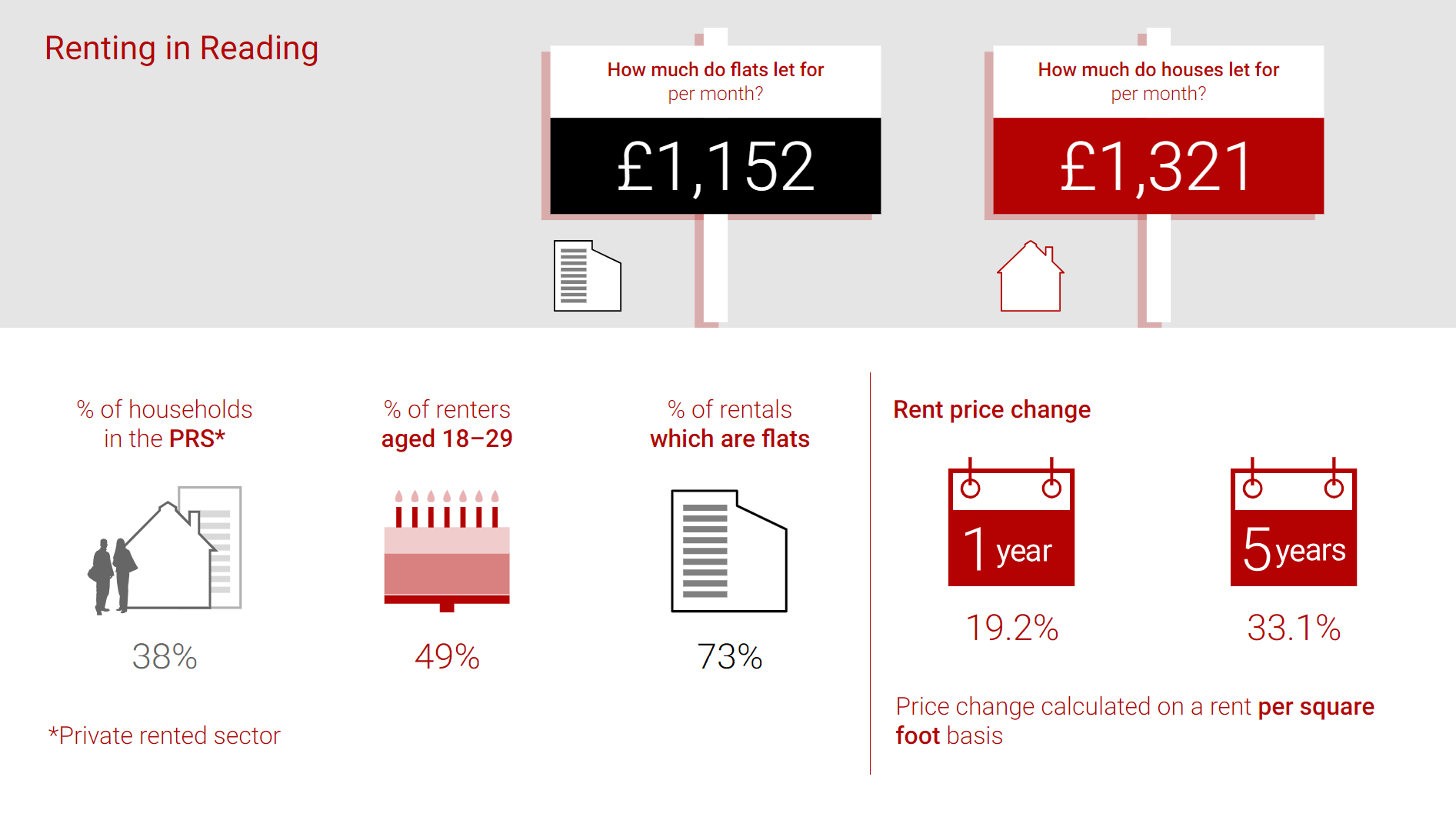

Over the last 12 months, the average rent achieved for homes let in Reading was £1,192 per month. This is a +19% change on the previous 12 month period.

73% of homes let in the past 12 months were flats, achieving an average rental value of £1,152 per month. Houses achieved an average rent of £1,321 per month.

28% of renters are aged between 25 and 29.