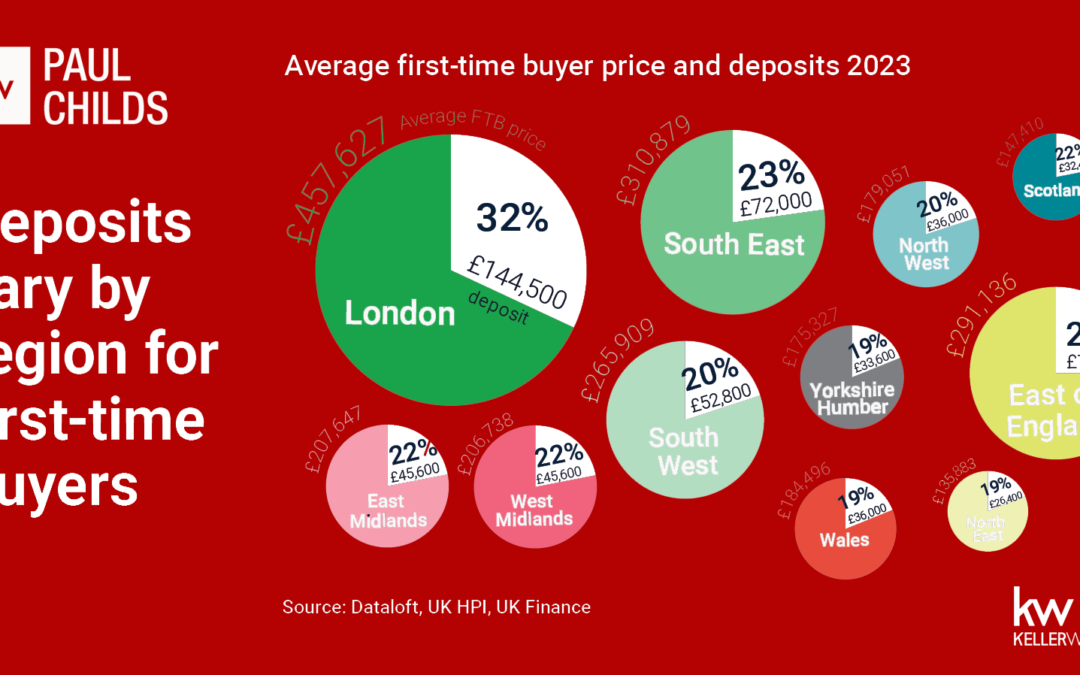

- To buy a home in the UK, first-time buyers have an average deposit of between £26,400 and £144,500.

- The average deposit paid by a first-time buyer in the UK is 24% of the purchase price (UK Finance), with many putting down a larger deposit down for their first home.

- Most expensive is London, where the average deposit is £144,500, almost a third of the average sale price.

- Mortgages aimed at first-time buyers, such as the 100% deposit or the shared ownership scheme, can work out cheaper than renting and have helped many onto the property ladder. Source: #Dataloft, UK HPI, UK Finance

Aspiring first-time buyers in the UK are on the lookout for their dream homes, but there’s a crucial factor they need to consider before diving into the property market – the deposit requirement. In this blog, we’ll explore how deposits vary across different regions in the UK and its implications for first-time buyers.

Understanding Regional Deposit Differences for First-Time Buyers in the UK

When buying a home in the UK, the deposit is a significant financial hurdle. It represents a percentage of the property’s purchase price that buyers need to pay upfront. However, the deposit percentage can fluctuate depending on the region where buyers wish to invest in real estate.

Regional Disparities in Deposit Requirements

Each region in the UK has its unique property market, and this reflects in the deposit requirements for first-time buyers:

London and the Southeast: In the vibrant capital city and its surrounding areas, property prices are sky-high. Consequently, first-time buyers in London and the Southeast may face deposit requirements ranging from 15% to 25% of the property’s value.

Northern Regions: Up north in regions like the Northwest and Northeast, property prices are generally more affordable. Here, first-time buyers can expect deposit requirements ranging from 5% to 10%, making it comparatively easier to enter the property market.

Wales and Scotland: Wales and Scotland offer diverse options for first-time buyers. In major cities like Cardiff and Edinburgh, deposit requirements can mirror those in certain parts of England. However, rural areas and smaller towns may present more budget-friendly choices.

Southwest and Midlands: The Southwest and Midlands regions fall in between, with deposit requirements typically ranging from 10% to 15%, depending on local market conditions.

Implications for First-Time Buyers

Understanding the regional variations in deposit requirements is crucial for first-time buyers aiming to make their homeownership dreams a reality:

Saving Goals: Prospective buyers must assess the deposit requirements in their desired region and set realistic saving goals accordingly. A substantial deposit not only boosts the chances of obtaining a mortgage but may also lead to more favourable interest rates.

Location Choices: Flexibility in location preferences allows buyers to explore areas with lower deposit requirements, expanding their options and finding potentially hidden gems in the property market.

Government Schemes: First-time buyers should explore government-backed schemes like Help to Buy, which can ease the deposit burden and provide more accessible routes to homeownership.

As the UK real estate market thrives, first-time buyers must consider the regional variations in deposit requirements. By setting informed saving goals, exploring diverse location options, and utilizing available government schemes, prospective homeowners can navigate the deposit landscape and turn their property dreams into a reality. Happy house hunting in the diverse and exciting UK property market!