Mortgage Approvals, a Year in Review to Date

In the intricate world of real estate, understanding the dynamics of mortgage approvals is akin to deciphering the pulse of the housing market. As we take a reflective journey through the year, it becomes evident that mortgage approvals play a pivotal role in shaping residential sales activity. In this blog post, we’ll embark on a year-in-review of mortgage approvals, shedding light on their significance as a leading indicator, fluctuations in approval numbers, the influence of inflation, and the seasonal factors impacting the market.

Mortgage Approvals as Leading Indicators

To appreciate the role of mortgage approvals, it’s essential to recognize that they lead trends in residential sales activity by approximately three months. Therefore, mortgage approvals serve as a key leading indicator for gauging forthcoming market activity. Monitoring these approvals provides valuable insights into the state of the real estate landscape.

Fluctuations in Approval Numbers

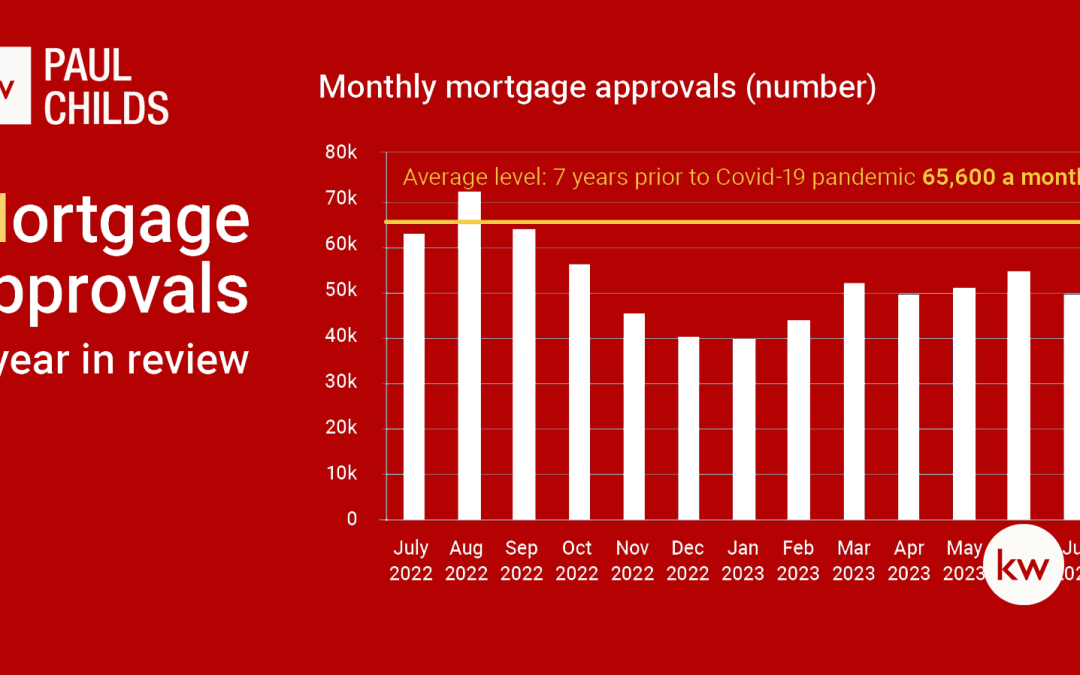

As we examine the numbers, it becomes evident that the count of mortgage approvals has seen fluctuations throughout the year. While there has been an upward trajectory since the start of 2023, it’s worth noting that approval levels remain below the pre-pandemic norm. In the year leading up to July, monthly mortgage approvals averaged 51,600. This figure represents a 21% reduction compared to the levels recorded in the seven years prior to the onset of the Covid pandemic. The resilience of the market is evident, but it is still on the path to recovery.

Inflation, Interest Rates, and Market Activity

Inflationary pressures have loomed large in recent times, causing concern among market observers. However, the latest data on inflation has provided a glimmer of hope. Forecasters predict that interest rates will peak this year and subsequently begin to decline in 2024. As market activity tends to react to shifts in economic conditions, any uptick in market activity is expected to manifest first in mortgage approvals.

Seasonal and Economic Influences

A closer look at mortgage approvals reveals that they hit their lowest point in December 2022 and January 2023. While seasonal factors undoubtedly played a role in this downturn, it was largely a reaction to inflation and the uncertainty surrounding interest rates. This period of cautiousness among borrowers and lenders underscores the sensitivity of the real estate market to economic fluctuations and policy changes.

What To Expect In The Road Ahead

As we wrap up this year in review of mortgage approvals, it’s clear that they hold the key to understanding the broader trends in the real estate market. While there has been an upward trend in approvals since the beginning of 2023, the market is still in a state of transition, navigating through the aftermath of the Covid-19 pandemic and responding to changing economic conditions.

The coming months will be crucial in determining the trajectory of mortgage approvals and, consequently, the housing market. The optimism stemming from the easing of inflationary pressures and forecasts of declining interest rates offers a glimpse of hope for prospective homebuyers and property enthusiasts.

In summary, mortgage approvals are not just numerical statistics; they are the heartbeat of the real estate market, reflecting the complex interplay of economic factors, seasonal influences, and buyer sentiment. By closely monitoring these indicators, we can gain valuable insights into the evolving landscape of real estate.

At Keller Williams we have in-house mortgage advisors who can help with any questions you may have when it comes to finding out more which product is bests for you.

Source: Data provided by #Dataloft and the Bank of England.